Johannes Eisele | AFP | Getty Images

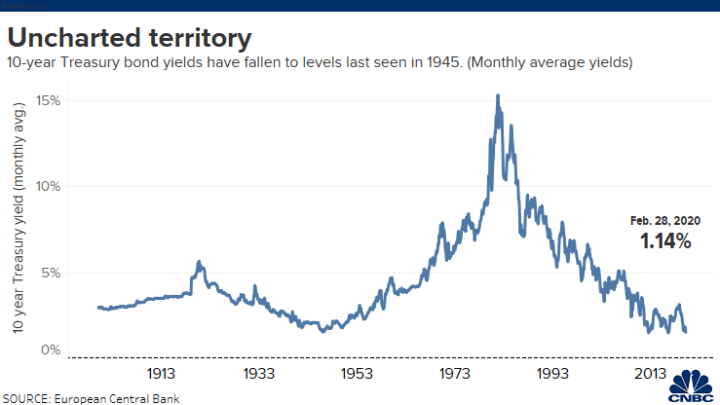

The coronavirus outbreak has pushed the yield on the 10-year Treasury bond to historic lows, marking the latest milestone in what has been a decades-long decline.

The moves have put the daily rate at levels not seen since at least the 1960s. According to data from the European Central Bank, it might be an even more historic fall.

The rate hit 1.116% on Friday, more than 30 basis points below where it closed the week before. Before this week’s tumble, the recent low point for the 10-year yield had come at 1.37% in July 2016.

Monthly averages of the 10-year show that the yield has never been this low for a sustained amount of time. It is possible that a move on a given day was lower than 1.18%, but it hasn’t held.

This latest drop has come as the coronavirus outbreak has muddied the outlook for the global economy and rattled equity markets. Bond yields move in the opposite direction of prices, so they fall when investors buy safer bonds and sell riskier assets. With major U.S. stock indexes plunging more than 10% this week, money has crowded into bonds.

The 10-year yield is a key measure throughout the economy because it used to anchor interest rates for other debt. For example, a falling 10-year rate often leads to lower mortgage rates.

Low rates on governments are not just an American phenomenon. Aggressive easing by central banks around the world since the financial crisis has pushed many benchmark interest rates into negative territory, making U.S. government debt one of the few ultra-safe assets that still has a positive yield.

Guggenheim’s Scott Minerd said that a continued environment of loose monetary policy from Central Banks could send U.S. interest rates down even further.

“We have everything on the yield curve now comfortably below 2% yield, making historic new lows. In all likelihood, if central banks keep the printing presses running, that’s just going to force bond yields down further, which will help support speculative assets elsewhere, including junk bonds,” Minerd said on Wednesday’s “Closing Bell.”

The U.S. central bank has kept its benchmark interest rate a historically low level since the financial crisis, putting it below 1% from Dec. 2008 until 2017.

After slowly raising the rate back above 2%, the Fed cut rates three times last year to place it at its current range of 1.5% to 1.75%. Options traders expect further aggressive action by the Federal Reserve, pricing in four cuts this year.

Central banks have historically hiked rates to stave off inflation, with the double-digit yields of the 1980s coming after oil supply shocks drove up inflation.

Ed Yardeni of Yardeni Research said that those episodes of inflation were “an aberration” and that slowing population growth in some of the world’s biggest economies has made inflation less of a concern going forward.

“Maybe that’s the one notion that needs to finally get buried is that inflation is going to make a comeback. And if in fact what central banks have been trying to do is fight off deflationary forces that remain strong, then there’s no reason to think that inflation will come back,” Yardeni said. “There’s no reason to expect that bond yields will move back up, and bond yields may very well stay historically low for the foreseeable future.”

By Jesse Pound, CNBC

All gamblers lose…

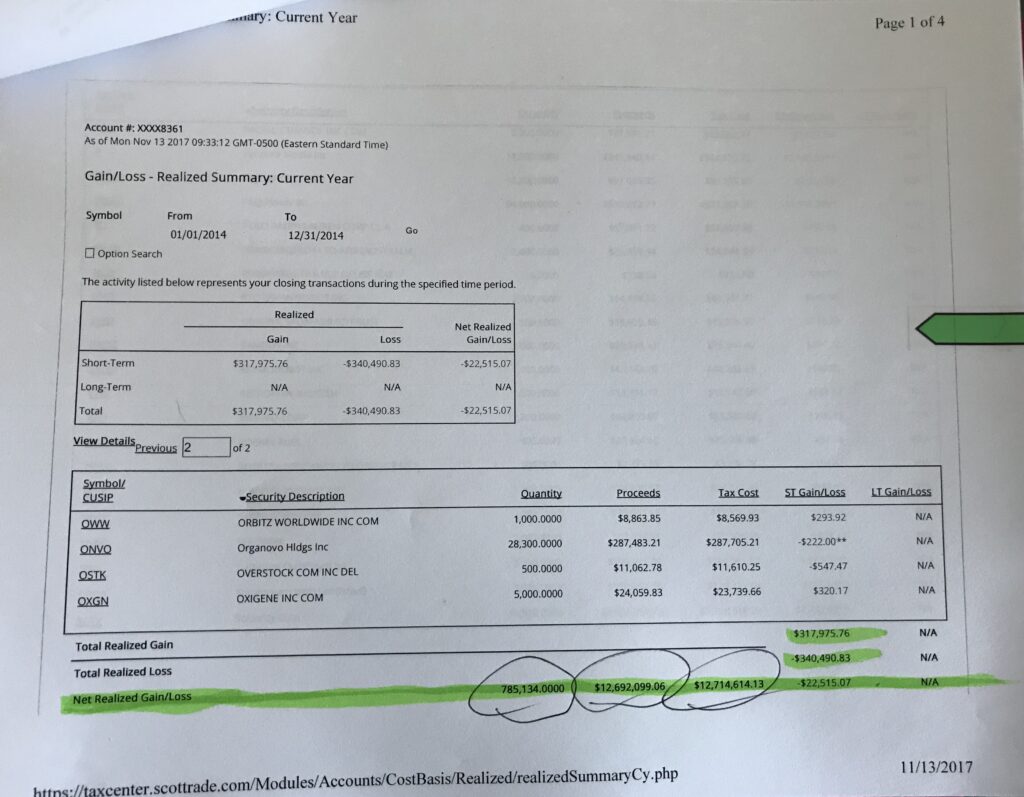

The only ones that haven’t lost just haven’t lost yet! I was involved heavily with the stock market for well over 20 years. During those 20 years, I’ve probably made and lost five, ten, or fifteen million dollars give or take a few million. These crashes come along every so often and wipe out two to five years in gains in just a few days or weeks. To short term traders, their entire accounts get wiped out in a matter of hours. I know this all too well, as I’ll show you a couple of snapshots of a couple of my old ScottsTrade accounts.

I was actually trading hundreds of millions of dollars a year in capital. Only to lose $20,000 in my best year, hundreds of thousands of dollars in an average year. So why did I do it? It’s called an addiction. Plain and simple. It’s actually more addicting than cocaine, heroin, sex, or almost any other vice. It plays on human nature. The people who make money in the stock market are never your traders or investors, but the corporate CEOs and investment banks along with of course the brokers who earn commissions. That’s about it. All other retail investors, people who buy stock on the open market, almost always lose. Go ahead and write down the names of anyone you know whose wealthy from trading stocks. Chances are you know nobody that is. In real estate, if you’re buying the right kind of property, at the right price, and manage it efficiently, you’re not actually gambling, you’re just taking a normal business risk that is hedged by owning the property. Therefore, you have a solid asset backing your investment. This is exactly what makes people wealthy.

So who do I know that is wealthy from real estate you ask?

Answer: 1. How about the person who owns the shopping center where you buy your food and clothes from?

- How about the landlord in the apartment complex you may live in?

- How about the guy building the new homes you see on the way to work each day?

- How about the guy who owns the warehouses that you pass on the highway going to and from town?

- How about the guy who owns just a few single-family rental properties?

- How about the guy who owns all that farmland you see driving down the road?

There are unlimited people in every city, in every state, who owns all the property. They are the wealthy ones. Not fools who have their money in the stock market. Only to watch it crash often losing 30% to 50% of their initial investment in a matter of days or weeks. The stock market is the purest form of gambling known to man. The saddest part is most people who put money in the stock market don’t see it that way, and that is why they are fools…I’m sorry I meant to say broke fools.

I’ll end with this. I met many traders who are nothing more than degenerate gamblers that have no net worth, but yet they have been trading for years. All have the same story with the exact same results. So the story goes…they all say they follow a strict set of rules, and that’s why they don’t lose money. I’m telling you they all lied. No different than a drug addict who lies. The gambler lies to protect his pride. The drug addict lies to protect his love being his drug of choice. Unfortunately for me, it took 20 years of a complete addiction to the stock market to somehow someway realize I was simply a degenerate gambler like all the rest. The only difference was I was always also in real estate the entire time I was a degenerate stock market gambler. Therefore, fortunately for me, I had assets and income from other sources that I could gamble away as that was exactly what I did. thank god that is all behind me. Don’t get me wrong I still watch stocks. Not daily but once in a while. Today though, I know better. Instead of being in the market and losing a fortune, I’m heavily into real estate and making a fortune. What I get out of watching this giant crashes is similar to a junkie that needs a fix. I get a certain high watching everyone else lose their money knowing that it is not me.

Just take a look at one of my statements below. I traded almost a billion dollars in stock in less than one year from just one computer and with all of my knowledge of the market. I still could not make a profit. Neither can anyone else. And now you have the rest of the story.

About The Author

- Robert Louis Annenberg Is a 40 year seasoned property owner, manager, investor, builder/developer and business man who is also an author of five published books to date (Amazon.com) and the chief editor of LifeQuestJournal.com. He can be reached at: Info@RobertAnnenberg.com and (201) 289-2500.

Latest entries

#3 The Annenberg ReportOctober 2, 2020A Few More Interesting Facts About Money I Think You Should Know…

#3 The Annenberg ReportOctober 2, 2020A Few More Interesting Facts About Money I Think You Should Know… #3 The Annenberg ReportOctober 1, 2020I was a Degenerate…What’s Your Excuse?

#3 The Annenberg ReportOctober 1, 2020I was a Degenerate…What’s Your Excuse? #3 The Annenberg ReportSeptember 23, 2020The Facts of Money…

#3 The Annenberg ReportSeptember 23, 2020The Facts of Money… #4 Real EstateJuly 11, 2020Cipriani Investments Sues Over Alleged Home Flipping Scheme

#4 Real EstateJuly 11, 2020Cipriani Investments Sues Over Alleged Home Flipping Scheme