The fact is people who own and manage properties get wealthy overtime Your wealth is accumulated from years of rental collection, mortgage reduction tax brakes and deprecation.

I find it often ridiculous as to the properties people buy and think they are getting a good deal. I’m talking about people sending me houses that they bought for the appraised value, only to talk about what is going to be worth in the future.

I was always a valued investor. I want my value the day that I buy the property. I’m not waiting for years. I’m in this now, and for the future. However, make no mistake, there better be value in it now, or I will just walk away.

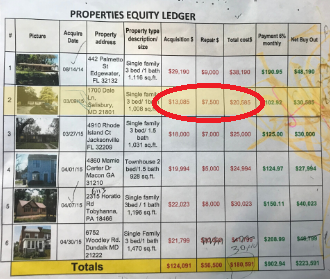

Most of these amazing deals were properties I bought in 2014 and 2015. They were leftovers from the banking crash that banks were not able to sell. I came in with the cash, closed in a few days, and bought these properties for about 20 cents on the dollar.

Just look at the combined wealth in these six little ugly properties, all once bank-owned, but now owned by me! Please focus on property number 2 as you look at my ugly house banner ad. For starters, the banner ad shows my Salsbury house worth $80,000 retail. (Note: I made that banner ad three years ago.)

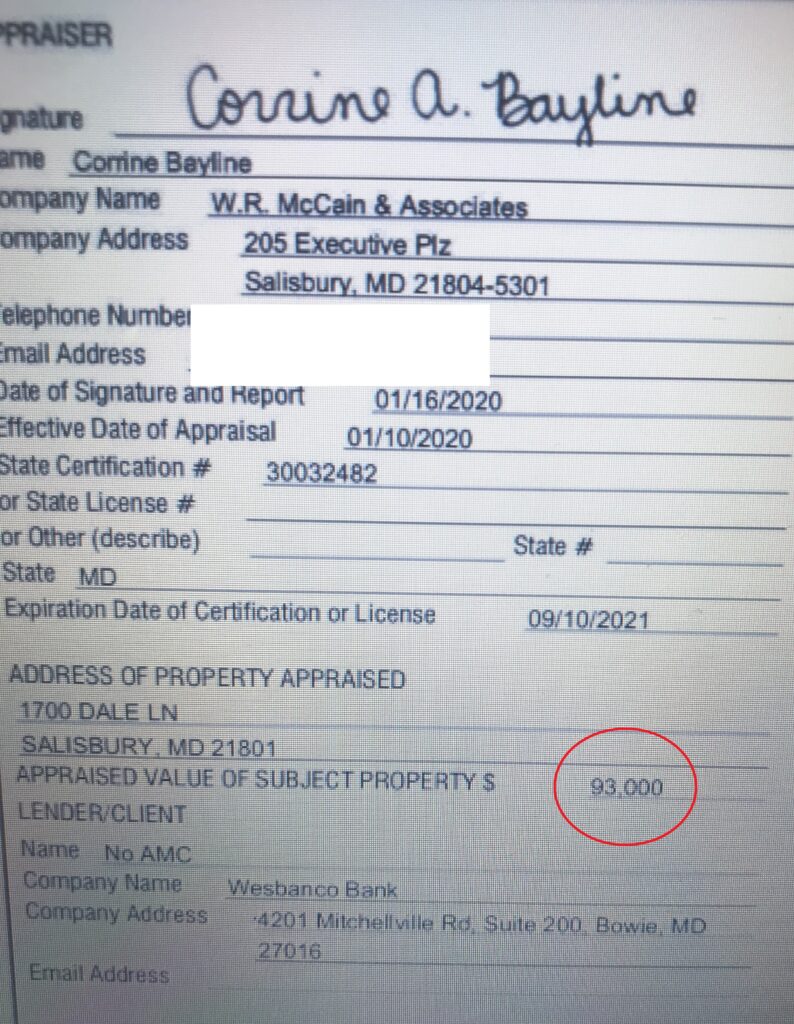

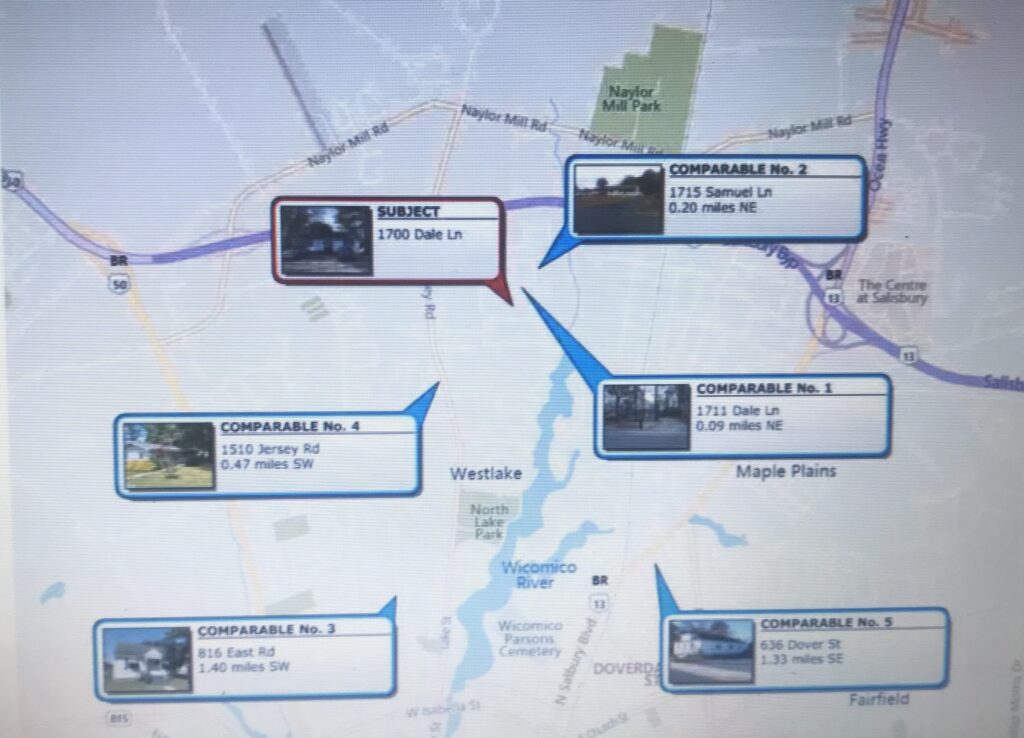

Today, that property just appraised at $93,000. I only had $20,000 in the house after repairs. I also collected an average rent price of $1,000 per month over the course of the last four years. So in rental income alone, we’re looking at about $40,000 combined with the equity of $70,000. Now, you’re talking combined rent and equity of $110,000! So would you rather buy a $100,000 house and pay $100,000 leaving you with zero equity or do it my way making eight to ten times your money on each property. If you look at the other properties on the list, I averaged a 150% return on every property! Note: these are just six properties they are not examples. They are real. They are mine. I collect the rent on them every month. I repair them. I pay taxes and insurance. Along with hundreds more that I own. there is the only reason I am able to do this and one reason only. I KNOW HOW TO! How about you?

(As the years go by the principal balance owed decreases, rents go up You get big tax breaks etc.)

About The Author

- Robert Louis Annenberg Is a 40 year seasoned property owner, manager, investor, builder/developer and business man who is also an author of five published books to date (Amazon.com) and the chief editor of LifeQuestJournal.com. He can be reached at: [email protected] and (201) 289-2500.

Latest entries

#3 The Annenberg ReportOctober 2, 2020A Few More Interesting Facts About Money I Think You Should Know…

#3 The Annenberg ReportOctober 2, 2020A Few More Interesting Facts About Money I Think You Should Know… #3 The Annenberg ReportOctober 1, 2020I was a Degenerate…What’s Your Excuse?

#3 The Annenberg ReportOctober 1, 2020I was a Degenerate…What’s Your Excuse? #3 The Annenberg ReportSeptember 23, 2020The Facts of Money…

#3 The Annenberg ReportSeptember 23, 2020The Facts of Money… #4 Real EstateJuly 11, 2020Cipriani Investments Sues Over Alleged Home Flipping Scheme

#4 Real EstateJuly 11, 2020Cipriani Investments Sues Over Alleged Home Flipping Scheme