Global stock markets tumbled further Wednesday amid mounting fears about the deadly coronavirus’s spread outside China as US futures hinted at further selling.

London’s blue-chip FTSE 100 index fell 2 percent to a one-year low of 6,871.85 as world leaders warned countries to prepare for outbreaks of the virus that has killed more than 2,700 people.

The DAX index in Germany and Paris’s CAC 40 had recently dropped 1 percent and 0.7 percent, respectively, after Japan’s benchmark Nikkei 225 index closed down about 0.8 percent at 22,426.19. The Kospi index in South Korea — where 1,261 coronavirus cases have been reported — dropped 1.2 percent to finish at 2,076.77.

Investors appeared worried about the growing probability that the epidemic will spread worldwide and kneecap the global economy after spates of coronavirus cases emerged in Italy, Japan, South Korea, and Iran, according to Yung-Yu Ma, the chief investment strategist at BMO Wealth Management.

“That really woke up the market,” Ma told the Associated Press.

Wall Street futures were volatile in the early morning but recently pointed to a further drop for the Dow Jones Industrial Average, which lost more than 1,900 points in the last two trading days.

Dow futures were down 51 points, or about 0.2 percent, at 27,066.00 as of 7:29 a.m. Nasdaq futures had recently dropped 0.1 percent to 8,845.00 while S&P 500 futures were down less than 0.1 percent at 3,131.00.

The global stock selloff continued after the World Health Organization said the coronavirus epidemic had peaked in China but warned other nations to get ready for an outbreak to hit. The Centers for Disease Control and Prevention called the virus a “severe public health threat” and said it will likely spread further in the US, where 53 cases had been reported as of Tuesday.

“It’s not so much a question of if this will happen anymore, but rather more a question of exactly when this will happen — and how many people in this country will have a severe illness,” the CDC’s Dr. Nancy Messonnier told reporters Tuesday.

By Noah Manskar, The New York Post

There are a few kinds of people in the stock market. 1. People who start with a lot of money and end up with very little money. (These are the risk-takers, gamblers, and those in for a quick buck.) 2. Long term investors such as 401k holders and other retirement type of people. Unfortunately, after commissions, taxes, and other fees most of these long term investors rarely average over 6% return annually. Which means they would need $1 million dollars just to make a measly $60,000. Then they would owe taxes on the $60,000. Sadly, this is far too often the case, and it’s mainly because of ignorance. They simply don’t know how to make money from their money. Therefore, they resort to the stock market. I never met one person rich from the stock market. In fact, I never met anyone making any money at all from investing in the stock market.

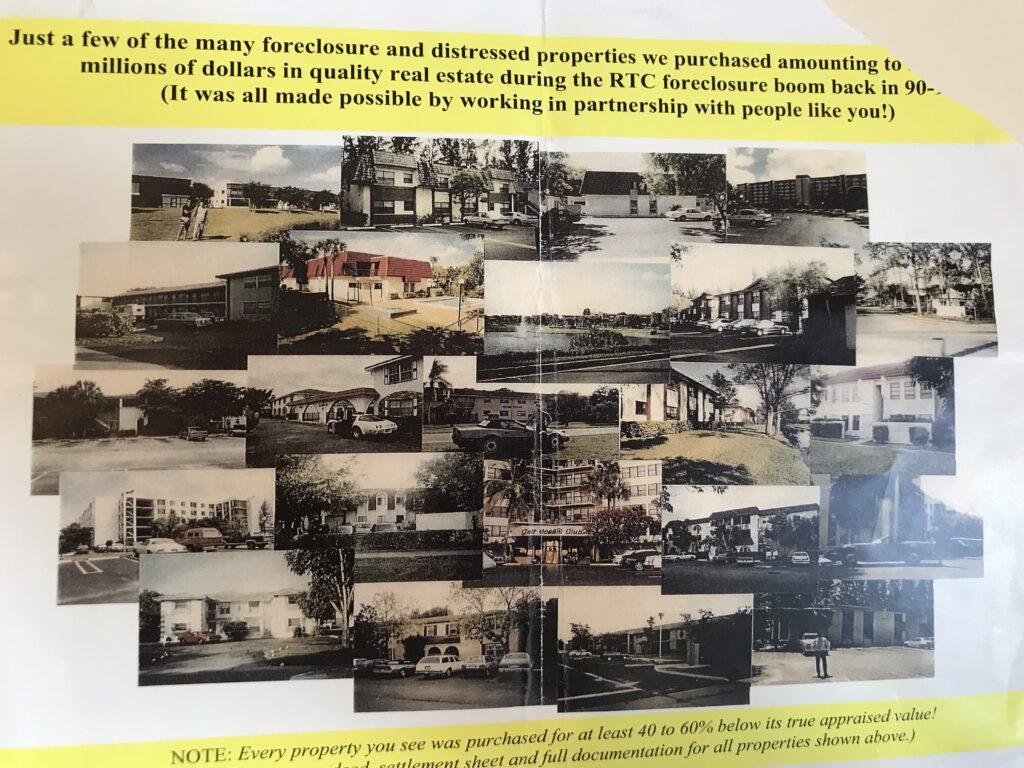

Real estate is a different story. There are countless real estate millionaires in every city, in every state worldwide. Real estate is the universal asset of choice for intelligent and savvy investors. So many of these investors are wealthy beyond their wildest imaginations. All simply from owning and managing their own personal real estate properties. Maybe you should too?

About The Author

- Robert Louis Annenberg Is a 40 year seasoned property owner, manager, investor, builder/developer and business man who is also an author of five published books to date (Amazon.com) and the chief editor of LifeQuestJournal.com. He can be reached at: Info@RobertAnnenberg.com and (201) 289-2500.

Latest entries

#3 The Annenberg ReportOctober 2, 2020A Few More Interesting Facts About Money I Think You Should Know…

#3 The Annenberg ReportOctober 2, 2020A Few More Interesting Facts About Money I Think You Should Know… #3 The Annenberg ReportOctober 1, 2020I was a Degenerate…What’s Your Excuse?

#3 The Annenberg ReportOctober 1, 2020I was a Degenerate…What’s Your Excuse? #3 The Annenberg ReportSeptember 23, 2020The Facts of Money…

#3 The Annenberg ReportSeptember 23, 2020The Facts of Money… #4 Real EstateJuly 11, 2020Cipriani Investments Sues Over Alleged Home Flipping Scheme

#4 Real EstateJuly 11, 2020Cipriani Investments Sues Over Alleged Home Flipping Scheme