Welcome back to The Annenberg Report, my weekly newsletter bringing you the latest trends in real estate investing, building, development, and property management to help you with building wealth the same way I do from owning and managing my own portfolios of income-producing, equity-rich real estate nationwide!

A Few Facts of Money I Think You Should Know…

Without a doubt I am the poster boy for a degenerate! No question about it! I lived like a degenerate. I only associated with other degenerates. Therefore, I was a degenerate! To be more specific I was really a financial degenerate! Make no mistake about it I was never alone as I always had numerous degenerate friends and associates who were just a phone call away!

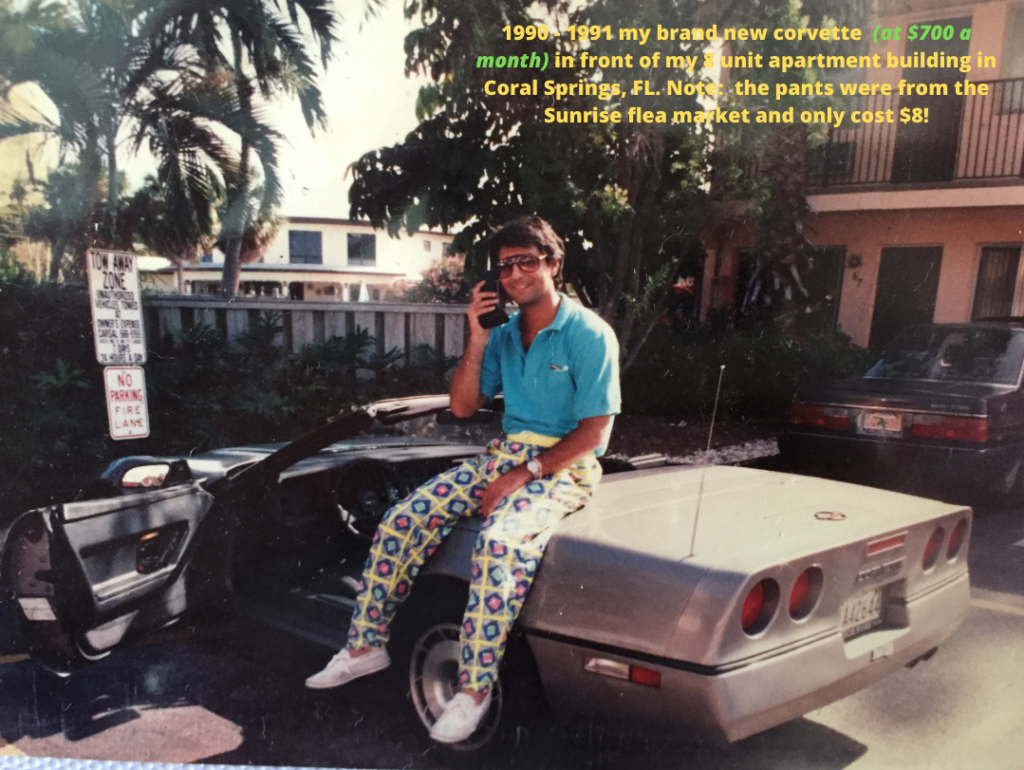

I know exactly when I sunk into the world of being a true degenerate. Not long after I moved to South Florida (1990), I accumulated a sizable real estate portfolio of income-producing properties mainly in West Broward County. (See below)

It was a magical time for sure. Young guy, 30 years old with money and time on my hands from being a property owner in South Florida I could never asked for more. Although it was a recipe for disaster for a bipolar degenerate like myself!

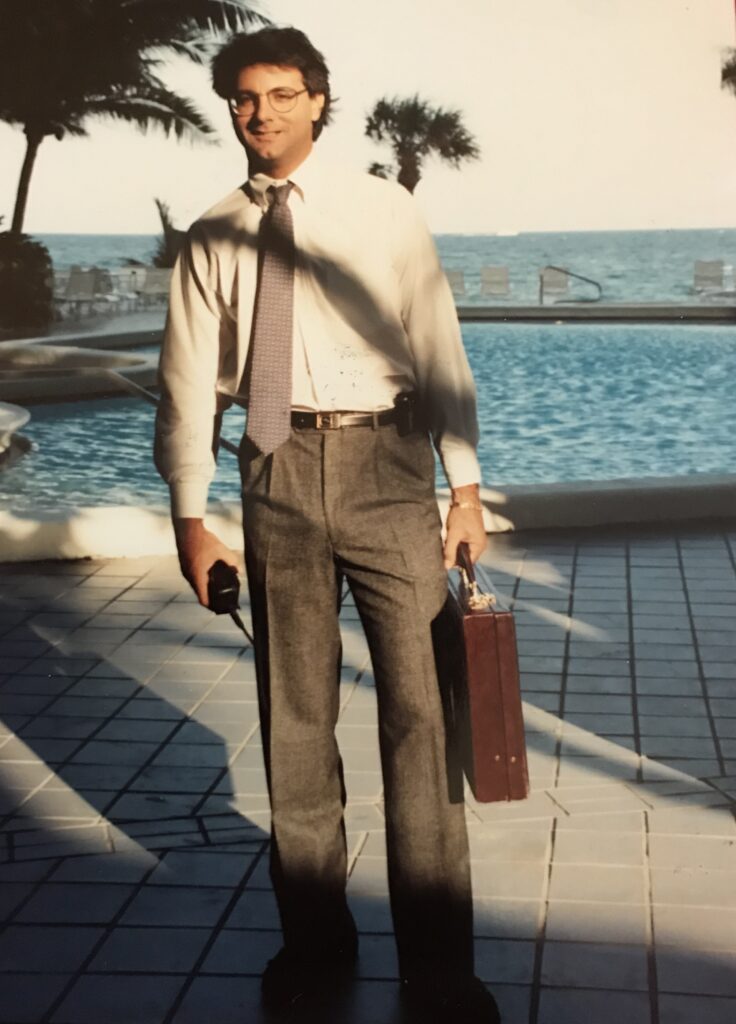

As I open my first telemarketing room on Cypress Creek Road I would put on a suit and tie and go to work everyday feeling on top of the world. How could I not? (I’ve got a brand new corvette convertible with a monthly payment of $700 a month my first big mistake. Then I bought a beautiful Harley Davidson motorcycle with a payment of $500 a month.

Then a bought a million dollar custom built 50 foot scarab with a payment of $1,500 a month. Next, leased a beautiful brand new Mercedes Benz convertible for $1,700 a month.) Don’t forget I ate out three meals a day at all the good Fort Lauderdale watering holes! When the sun went down, I would be drinking in the nightclubs, chasing the never ending supply of beautiful girls of Fort Lauderdale, and now I have a personal overhead I created of over $15,000 a month, (not including my office rent, salaries, and expenses of another $15,000 a month that went hand-in-hand with creating and living an image of a “fat cat.”)

Looking back I cannot even imagine how I kept that lifestyle up for fifteen years, but I did. I also degenerated by doing so. The icing on the cake for being a degenerate was sinking into a gambling addiction with the stock market. I was a five day a week, 8 hour a day trader losing millions of dollars a year, and lying about it like everyone else does!

The only thing that saved me from not being on the back of a garbage truck for the rest of my life, was the fact that I was a property owner, and I have the knack to pick up properties usually $0.50 on the dollar, rent them out, then sell them a few years down the road for huge profits. Today, I do exactly that although I am not a degenerate, stock market junkie anymore. My degenerate days are long behind me! Note: most degenerates are fun to be with and are often disguised behind the face of a sad lost soul. Such was the case with me.

Today (2020), all the people I associated with that were “stock traders, stock brokers, and other self-claimed wall street wannabes” are completely broke in their late years in life without owning their own home possibly sharing an apartment, or living with their parents, but all have one thing in common. They were degenerates, make no mistake about it, but so many still are degenerates to this day. Thank I’m not!

So what’s the moral of this story? For starters…

- Unless you are very wealthy if you don’t own your own home you’re paying somebody to live! If you do own your own home, you are getting paid to live!

- If you buy a brand new car and finance it and you are not very wealthy you will only get poorer and poorer every month as the value of your new car decreases ever so rapidly to the point that after the first six months you owe more money on your car than what it’s worth!

- Being a gambler will absolutely destroy anyone. It’s a self-destructive force that is more powerful than you can ever imagine. Note: you can gamble in anything: business, sports, stock market, casino, etc. with the exact same result in the end. Losing all your money!

It only takes doing a few things different to turn your life around. Here’s what I did that changed my life.

- I always own a house rather than rent. I’ve rented before out of duress only, and knew it was a financial disaster. Anytime I ever rented it was a bridge until I could buy my next home.

- I will never buy a new car because I know the financial beating you will take by doing so. (Although I must admit I really want a 2020 Corvette they’re absolutely insane looking, but I know better. Instead of buying one now for $80,000 and owning it while it drops in value to $50,000 in three years, I’ll simply wait it out and get a good used one at a bargain.) I like to drive cool used cars that I can make money on after driving them for a little while. (See Facebook classic car investors)

- I never gamble because I never met a gambler whose rich. All gamblers are degenerate broke fools. I sure don’t want to be one of them. Remember you can gamble with anything. Even real estate can be a gamble. If you’re buying the wrong property for the wrong price and you don’t know what you’re doing. What you think is an investment will be nothing more than gambling in disguise!

In closing, imagine right now if you never had to work again and were able to pay all your bills every month, eat out whenever you want, take a trip here and there and have money coming in every month from something you did yesterday and the day before that’s paying off for you today and tomorrow!

alternative investments, annuity, consulting, crowd funding, dow jones, financial advising, financial advisor, financial consulting, investing, ira, money manager, mortgages, nasdaq, realestate, real estate crowd funding, retirement, retirement income, sp500, stock market, life coach management, mortgage, realty, realtor property, sales, real estate agent property investments, property investing, lifequest journal, robert annenberg, lifequest living

About The Author

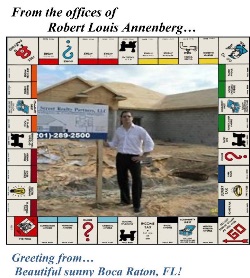

- Robert Louis Annenberg Is a 40 year seasoned property owner, manager, investor, builder/developer and business man who is also an author of five published books to date (Amazon.com) and the chief editor of LifeQuestJournal.com. He can be reached at: Info@RobertAnnenberg.com and (201) 289-2500.

Latest entries

#3 The Annenberg ReportOctober 2, 2020A Few More Interesting Facts About Money I Think You Should Know…

#3 The Annenberg ReportOctober 2, 2020A Few More Interesting Facts About Money I Think You Should Know… #3 The Annenberg ReportOctober 1, 2020I was a Degenerate…What’s Your Excuse?

#3 The Annenberg ReportOctober 1, 2020I was a Degenerate…What’s Your Excuse? #3 The Annenberg ReportSeptember 23, 2020The Facts of Money…

#3 The Annenberg ReportSeptember 23, 2020The Facts of Money… #4 Real EstateJuly 11, 2020Cipriani Investments Sues Over Alleged Home Flipping Scheme

#4 Real EstateJuly 11, 2020Cipriani Investments Sues Over Alleged Home Flipping Scheme